$ Wisdom from Warren Buffet …

$1,000 invested in 1965 = $33 million in 2025.

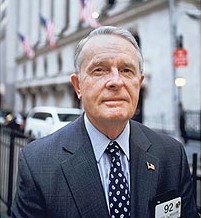

My late friend and former neighbor in Monmouth Beach, James J. Maguire, worked on Wall Street for over 60 years — during which time he had a close business association with Warren Buffett.

If you know anything at all about money matters — and even if you don’t — you’ve probably heard of Buffett. Known as the Oracle of Omaha for his unmatched financial and business prowess, he is considered “America’s Greatest Investor.” His current net worth is estimated at $150 billion+.

Jim Maguire — something of a Wall Street legend himself — was known as “Chief” by his colleagues. He was worth knowing (see below). A CNBC report on his 2016 death at age 86, called him “one of the great titans of the New York Stock Exchange floor.”

The highlight of Jim’s illustrious career included a long professional and personal relationship with Buffett — serving as a the main trader for his investment holding company, Berkshire Hathaway. Buffett often referred to Maguire as the “World’s Greatest Specialist” — even to my daughter Lauren, who got to meet the “Oracle” in “Omaha” as part of a Fordham University women’s group visit to Nebraska in 2015.

From Umbrellas to Billionaires — the Life of Jim Maguire: HERE

Maguire first met Buffet in 1988 and “a lasting friendship was born” and the two men spoke monthly. Maguire called Buffett a “regular guy” and “very witty, loyal, and generally undemanding, although I wouldn’t want to be on the other end of a bargaining table with him.”

When Buffett started Berkshire Hathaway (originally a Massachusetts textile firm) in 1965, a $1,000 investment in that company then would be worth about $33 million today. Buying in today is no small proposition, however; a single class “A” share of the stock sells for about $500,000; the class “B” shares are about $750. The company — valued today at $1 trillion — has large holdings in Apple, American Express, Coca-Cola, Bank of America, Kraft-Heinz, and Chevron. Buffet — who will retire at year end — has pledged to give 99% of his fortune to charity.

With his amazing record, a regular person might like to know Buffet’s investment advice to his own family. In a recent shareholder’s letter he remarks: “90% in a low-cost S&P 500 index fund and 10% in short-term government bonds.” For investors starting out, Buffett offers these gems about life and money:

• “Failure isn’t falling down, it’s staying down.”

• “Don’t save what’s left after spending, spend what’s left after saving.”

• “You can’t make a good deal with a bad person.”

• “The more you learn, the more you earn.”